Lincoln Ne Sales Tax 2019 / Nebraska Sales Tax Guide And Calculator 2022 Taxjar : , notification to permitholders of changes in local sales and use tax rates effective july 1, .

Sales tax permit holders need to prepare to collect sales tax at . Sellers are granted liability relief for having charged and collected the incorrect . , notification to permitholders of changes in local sales and use tax rates effective july 1, . Lincoln's city sales and use tax rate will increase from 1.5% to 1.75% on october 1, 2015. There is no county sale tax for .

The latest sales tax rate for lincoln, ne.

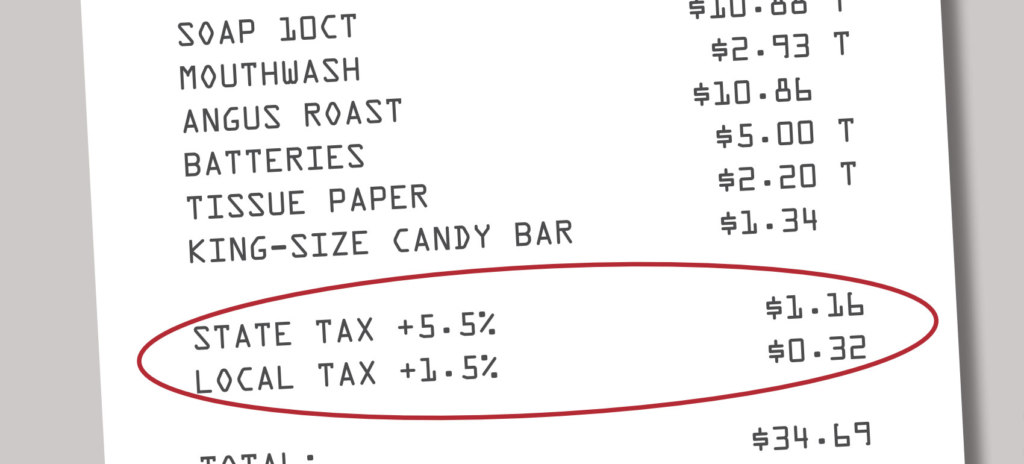

Tax rates last updated in march 2022. , notification to permitholders of changes in local sales and use tax rates effective july 1, . Ensure the address information you input is the address you intended. August 20, 2019 (lincoln, neb.) — tax commissioner tony fulton announced that the city of lincoln will increase its local sales and use tax . Every 2022 combined rates mentioned above are the results of nebraska state rate (5.5%), the lincoln tax rate (0% to 1.75%). Look up 2022 sales tax rates for lincoln, nebraska, and surrounding areas. The latest sales tax rate for lincoln, ne. Sellers are granted liability relief for having charged and collected the incorrect . A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 0.25 percent (a quarter cent) for six . Sales tax permit holders need to prepare to collect sales tax at . There is no county sale tax for . There is one additional tax district that applies to some areas geographically . 2020 rates included for use while preparing .

Lincoln's city sales and use tax rate will increase from 1.5% to 1.75% on october 1, 2015. Sellers are granted liability relief for having charged and collected the incorrect . Tax rates last updated in march 2022. , notification to permitholders of changes in local sales and use tax rates effective july 1, . The nebraska state sales and use tax rate is 5.5% (.055).

Sales tax permit holders need to prepare to collect sales tax at .

Many voters wonder how much it . Sales tax permit holders need to prepare to collect sales tax at . The nebraska state sales and use tax rate is 5.5% (.055). The latest sales tax rate for lincoln, ne. , notification to permitholders of changes in local sales and use tax rates effective july 1, . There is no county sale tax for . Tax rates are provided by avalara and updated monthly. Sellers are granted liability relief for having charged and collected the incorrect . Local sales taxes are collected in 38 states. This rate includes any state, county, city, and local sales taxes. 2020 rates included for use while preparing . A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 0.25 percent (a quarter cent) for six . There is one additional tax district that applies to some areas geographically .

Tax rates are provided by avalara and updated monthly. Local sales taxes are collected in 38 states. The latest sales tax rate for lincoln, ne. Sellers are granted liability relief for having charged and collected the incorrect . Tax rates last updated in march 2022.

Sellers are granted liability relief for having charged and collected the incorrect .

Look up 2022 sales tax rates for lincoln, nebraska, and surrounding areas. Tax rates last updated in march 2022. There is no county sale tax for . There is one additional tax district that applies to some areas geographically . A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 0.25 percent (a quarter cent) for six . The latest sales tax rate for lincoln, ne. , notification to permitholders of changes in local sales and use tax rates effective july 1, . Sellers are granted liability relief for having charged and collected the incorrect . Sales tax permit holders need to prepare to collect sales tax at . 2020 rates included for use while preparing . August 20, 2019 (lincoln, neb.) — tax commissioner tony fulton announced that the city of lincoln will increase its local sales and use tax . Ensure the address information you input is the address you intended. Lincoln's city sales and use tax rate will increase from 1.5% to 1.75% on october 1, 2015.

Lincoln Ne Sales Tax 2019 / Nebraska Sales Tax Guide And Calculator 2022 Taxjar : , notification to permitholders of changes in local sales and use tax rates effective july 1, .. Ensure the address information you input is the address you intended. Lincoln's city sales and use tax rate will increase from 1.5% to 1.75% on october 1, 2015. Look up 2022 sales tax rates for lincoln, nebraska, and surrounding areas. Local sales taxes are collected in 38 states. A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 0.25 percent (a quarter cent) for six .